BlackRock BlackStone financial meltdown during coronavirus panic

By Stew Webb

Federal Whistleblower

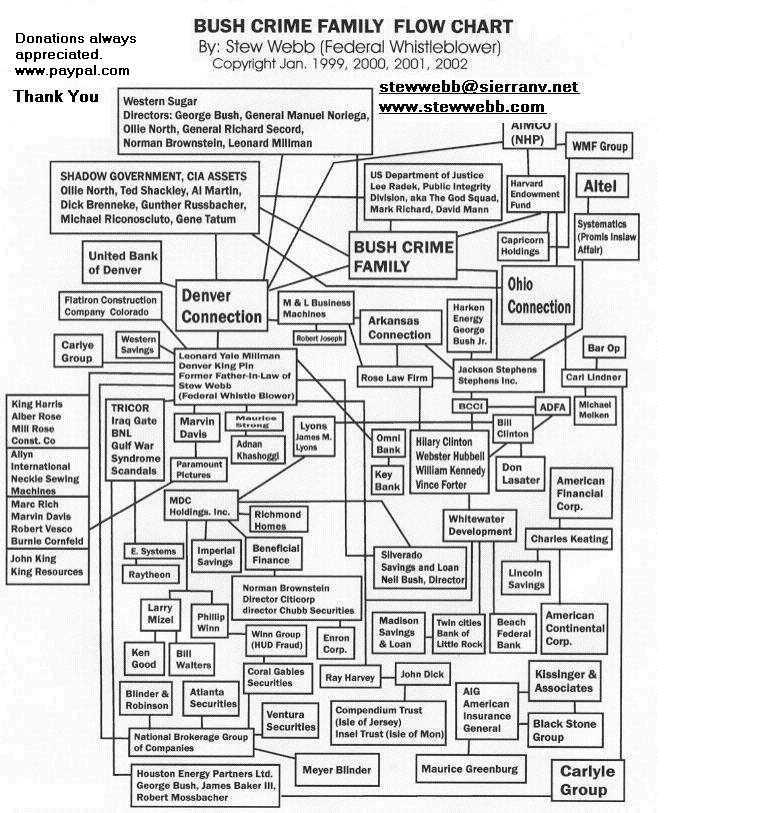

BlackStone was created by Pete Peterson as a “Buffer” for Leonard Millman, Larry Mizel, Neil Bush, Norman Brownstein, George HW Bush, Jeb Bush, Bill and Hillary Clinton, Crime Family monies derived from Iran Contra Drugs for Weapons was invested into BlackStone which created BlackRock which took over the Federal Reserve Bank.

This will be a series of articles I will be posting on Stew Webb

Over the next 30 days as I investigate the short and put options that I estimate was $50 plus Trillion Dollars over the past 30 days stolen from investors by Larry Mizel who was on the Board of Silverado Savings and Loan and who was the 2008 Bank Bailout Scamster who controls BlackStone Group.

This Wall Street Firm Has Quietly Gained Control Over the Financial Sector During Coronavirus Panic

BlackRock is gaining power because of this crisis.

Apr 5, 2020

By Shane Trejo

bigleaguepolitics.com/this-wall-street-firm-has-quietly-gained-control-over-the-financial-sector-during-coronavirus-panic

A big winner of the economic peril caused by the coronavirus pandemic has been the monolithic Wall Street management firm BlackRock, which has been granted sweeping new powers by the Federal Reserve.

Last month, the Fed named BlackRock as the adviser and investment manager for three emergency programs meant to prop up the fledgling markets. They are now tasked with controlling the primary market corporate credit facility (PMCCF), the secondary market corporate credit facility (SMCCF), and granting new bond and loan issuance.

Critics of the move fear that the agreement between the Fed and BlackRock are recreating the exact circumstances that have allowed systemic Wall Street corruption in the past.

Trending: Banished Journalist Laura Loomer’s $1.5 Billion Lawsuit Against Tech Giants Will Be Heard in Court

“By giving BlackRock full control of this debt buyout program, the Fed is further entwining the roles of government and private actors,” wrote many different consumer-advocate groups in a letter criticizing the BlackRock’s deal with the Fed.

“In doing so, it makes BlackRock even more systemically important to the financial system. Yet BlackRock is not subject to the regulatory scrutiny of even smaller systemically important financial institutions,” the letter added

BlackRock has become the world’s preeminent investment management corporation under the stewardship of its founder Larry Fink. Fink has exploited his Washington D.C. connections throughout his career, and he has particularly strong ties with former Secretary of State Hillary Clinton. Fink was expected to lead her Treasury Department if Clinton defeated President Donald Trump in 2016. With Washington D.C. in his back pocket, Fink has been able to dominate Wall Street despite no apparent expertise or even basic competency.

“His economic empire is less a result of his economic skills and competitiveness and more a result of his political connections and trillion-dollar state contracts,” wrote sociologist and geopolitical scholar James Petras about Fink’s career.

“Fink’s most famous financial product, mortgage-based securities led to the biggest collapse in world financial markets since the Great Depression,” Petras added.

BlackRock has grown into the world’s most powerful firm because of Fink’s success in peddling influence with politicians in the Washington D.C. swamp. They capitalized during the last economic crisis, benefiting mightily from sweetheart deals orchestrated under former President Barack Hussein Obama. While corporations were going under left and right in the 2008 economic crash, BlackRock was cleaning up and consolidating power.

They profited from the economic misery by being awarded lucrative government contracts, often without having to even bid on them. BlackRock was tasked with managing the proposed rescue operations of Bear Stearns, the American International Group and Citigroup. They also implemented a Federal Reserve program to resuscitate the beleaguered housing market and were brought on as consultants to evaluate Fannie Mae and Freddie Mac. Their growing influence was a major cause of controversy at the time.

“They have access to information when the Federal Reserve will try to sell securities, and what price they will accept. And they have intricate financial relations with people across the globe,” Sen. Chuck Grassley (R-IA) said in 2009. “The potential for a conflict of interest is great and it is just very difficult to police.”

“In other words, the conflict results in an enormous profit for the fund manager at the expense of the taxpayer,” wrote Neil M. Barofsky, the special inspector general for the Troubled Asset Relief Program, in a 2009 report about BlackRock’s gaming of the system.

In a decade’s time from 2009 to 2019, assets under the control of BlackRock skyrocketed in value from $1.3 trillion to $6.84 trillion. Cronyism has paid off for Fink, and BlackRock is perfectly situated to exploit coronavirus hysteria in order to commit another heist.

Petras noted: “Fink has turned BR into an empire by spending his time and energy in the politics of controlling and milking the US Treasury. Controlling this activity is more influential than the President of the United States or Pentagon in deciding who among the elite wins and who loses!”

BlackRock has maneuvered themselves into the same role they were in when they cashed out on the economic peril during the previous crash. While Americans struggle to pay the rent, BlackRock will be racking up trillions more in ill-gotten gains.

Related by Stew Webb

https://en.wikipedia.org/wiki/BlackRock

BlackRock

From Wikipedia, the free encyclopedia

Jump to navigation Jump to search

For other uses, see Black Rock (disambiguation).

Not to be confused with Blackstone Group.

| BlackRock, Inc. |

BlackRock headquarters in Midtown Manhattan, New York City.

| Type | Public |

| Traded as | NYSE: BLK S&P 100 component S&P 500 component |

| ISIN | US09247X1019 |

| Industry | Investment management |

| Founded | 1988; 32 years ago |

| Founders | • Robert S. Kapito • Laurence D. Fink |

| Headquarters | New York City, New York U.S. |

| Area served | Worldwide |

| Key people | Larry Fink (chairman and CEO) Robert Kapito (president) |

| Products | Asset management |

| Revenue | |

| Operating income | |

| Net income | |

| AUM | |

| Total assets | |

| Total equity | |

| Number of employees | |

| Subsidiaries | BlackRock Institutional Trust Company, N.A. BlackRock Fund Advisors BlackRock Group Ltd |

| Website | BlackRock.com |

BlackRock, Inc. is an American global investment management corporation based in New York City. Founded in 1988, initially as a risk management and fixed income institutional asset manager, BlackRock is the world’s largest asset manager, with $7.4 trillion in assets under management as of end-Q4 2019.[3] BlackRock operates globally with 70 offices in 30 countries and clients in 100 countries.[4] Due to its power and the sheer size and scope of its financial assets and activities, BlackRock has been called the world’s largest shadow bank.[5][6]

Contents

History

1988–1997

BlackRock was founded in 1988 by Larry Fink, Robert S. Kapito, Susan Wagner, Barbara Novick, Ben Golub, Hugh Frater, Ralph Schlosstein, and Keith Anderson[7] to provide institutional clients with asset management services from a risk management perspective.[8] Fink, Kapito, Golub and Novick had worked together at First Boston, where Fink and his team were pioneers in the mortgage-backed securities market in the United States.[9] During Fink’s tenure, he had lost $100 million as head of First Boston. That experience was the motivation to develop what he and the others considered to be excellent risk management and fiduciary practices. Initially, Fink sought funding (for initial operating capital) from Pete Peterson of The Blackstone Group who believed in Fink’s vision of a firm devoted to risk management. Peterson called it Blackstone Financial Management.[10] In exchange for a 50 percent stake in the bond business, initially Blackstone gave Fink and his team a $5 million credit line. Within months, the business had turned profitable, and by 1989 the group’s assets had quadrupled to $2.7 billion. The percent of the stake owned by Blackstone also fell to 40%, compared to Fink’s staff.[10]

By 1992, Blackstone had a stake equating to about 35% of the company, and Schwarzman and Fink were considering selling shares to the public.[11] The firm adopted the name BlackRock in 1992, and by the end of that year, BlackRock was managing $17 billion in assets. At the end of 1994, BlackRock was managing $53 billion.[12] In 1994, Blackstone Group’s Stephen A. Schwarzman and Fink had an internal dispute over methods of compensation[11] and over equity.[citation needed] Fink wanted to share equity with new hires, to lure talent from banks, unlike Schwarzman, who did not want to further lower Blackstone’s stake.[11] They agreed to part ways, so the BlackRock partners (Sue Wagner) orchestrated a deal to sell part of the company.[citation needed] In June 1994 Blackstone sold a mortgage-securities unit with $23 billion in assets to PNC Bank Corp. for $240 million.[13] The unit had traded mortgages and other fixed-income assets, and during the sales process the unit changed its name from Blackstone Financial Management to BlackRock Financial Management.[11] Schwarzman remained with Blackstone, while Fink went on to become chairman and CEO of BlackRock Inc.[11] In 1998, PNC’s equity, liquidity, and mutual fund activities were merged into BlackRock.[citation needed]

1999–2009

BlackRock went public in 1999 at $14 a share[14] on the New York Stock Exchange.[12] By the end of 1999, BlackRock was managing $165 billion in assets.[12] BlackRock grew both organically and by acquisition. In August 2004, BlackRock made its first major acquisition, buying State Street Research & Management’s holding company SSRM Holdings, Inc. from MetLife for $325 million in cash and $50 million in stock. The acquisition raised BlackRock’s assets under management from $314 billion to $325 billion.[15] The deal included the mutual-fund business State Street Research & Management in 2005.[13] BlackRock merged with Merrill Lynch Investment Managers (MLIM) in 2006,[12][16] halving PNC’s ownership and giving Merrill Lynch a 49.5% stake in the company.[17] In October 2007, BlackRock acquired the fund-of-funds business of Quellos Capital Management.[18][19]

The U.S. government contracted with BlackRock to help resolve the fallout of the financial meltdown of 2008. According to Vanity Fair, the financial establishment in Washington and on Wall Street believed BlackRock was the best choice for the job.[20] In 2009, BlackRock first became the No. 1 asset manager worldwide.[13] In April 2009, BlackRock acquired R3 Capital Management, LLC and took control of the $1.5 billion fund.[21] On 12 June 2009, Barclays sold its Global Investors unit (BGI), which included its exchange traded fund business, iShares, to BlackRock for US$13.5 billion. Through the deal, Barclays attained a near-20% stake in BlackRock.[22]

2010–2019

In 2010, Ralph Schlosstein, the CEO of Evercore Partners and a BlackRock founder, called BlackRock “the most influential financial institution in the world.”[23] On 1 April 2011, due to Sanofi’s acquisition of Genzyme, BlackRock replaced it on the S&P 500 index.[24]

In 2013, Fortune listed BlackRock on its annual list of the world’s 50 Most Admired Companies.[13] In 2014, The Economist said that BlackRock’s $4 trillion under management made it the “world’s biggest asset manager”, and it was larger than the world’s largest bank, the Industrial and Commercial Bank of China with $3 trillion.[6] In May of the same year, BlackRock invested in Snapdeal.[25]

In December 2014 a BlackRock managing director in London was banned by the British Financial Conduct Authority for failing the “fit and proper” test, because he paid £43,000 to avoid prosecution for dodging train fares. BlackRock said, “Jonathan Burrows left BlackRock earlier this year. What he admitted to the FCA is totally contrary to our values and principles.”[26][27]

At the end of 2014, the Sovereign Wealth Fund Institute reported that 65% of Blackrock’s assets under management were made up of institutional investors.[28]

By June 30, 2015, BlackRock had US$4.721 trillion of assets under management.[29] On August 26, 2015, BlackRock entered into a definitive agreement to acquire FutureAdvisor,[30] a digital wealth management provider with reported assets under management of $600 million.[31] Under the deal, FutureAdvisor would operate as a business within BlackRock Solutions (BRS).[30] BlackRock announced in November 2015 that they would wind down the BlackRock Global Ascent hedge fund after losses. The Global Ascent fund had been its only dedicated global macro fund, as BlackRock was “better known for its mutual funds and exchange traded funds.” At the time, BlackRock managed $51 billion in hedge funds, with $20 billion of that in funds of hedge funds.[32]

In March 2017, the Financial Times announced that BlackRock, after a six-month review led by Mark Wiseman, had initiated a restructuring of its $8bn actively-managed fund business, resulting in the departure of seven portfolio managers and a $25m charge in Q2, replacing certain funds with quantitative investment strategies.[33] In May 2017, BlackRock increased its stake in both CRH plc and Bank of Ireland.[34] By April 2017, iShares business accounted for $1.41tn, or 26 percent, of BlackRock’s total assets under management, and 37 percent of BlackRock’s base fee income.[35] In April 2017, BlackRock backed the inclusion of mainland Chinese shares in MSCI’s global index for the first time.[36]

Between October and December 2018, BlackRock’s assets dropped by US$468bn and fell below $6tn. It was the largest decline between quarters since September 2011.[3]

As of 2019, BlackRock holds 4.81% of Deutsche Bank, making it the single largest shareholder.[37] This investment goes back to at least 2016.[38]

In May 2019, BlackRock received criticism for the environmental impact of its holdings.[39] It is counted among the top three shareholders in every oil “supermajor” except Total, and it is among the top 10 shareholders in 7 of the 10 biggest coal producers.

2020

In his 2020 annual open letter,[40] CEO Fink announced environmental sustainability as core goal for BlackRock’s future investment decisions.[41] BlackRock disclosed plans to sell US$500 million in coal investments.[42]

Finances

For the fiscal year 2017, BlackRock reported earnings of US$4.970 billion, with an annual revenue of US$12.491 billion, an increase of 12.0% over the previous fiscal cycle. BlackRock’s shares traded at over $414 per share, and its market capitalization was valued at over US$61.7 billion in October 2018.[43] As of 2018, BlackRock ranked 237 on the Fortune 500 list of the largest United States corporations by revenue.[44]

| Year[1] | Revenue (million US$) | Net income (million US$) | Total Assets (million US$) | AUM[45] (million US$) | Price per Share (US$) | Employees |

| 2005 | 1,191 | 234 | 1,848 | 62.85 | ||

| 2006 | 2,098 | 323 | 20,469 | 103.75 | ||

| 2007 | 4,845 | 993 | 22,561 | 128.69 | ||

| 2008 | 5,064 | 784 | 19,924 | 144.07 | ||

| 2009 | 4,700 | 875 | 178,124 | 136.79 | ||

| 2010 | 8,612 | 2,063 | 178,459 | 3,561,000 | 145.85 | |

| 2011 | 9,081 | 2,337 | 179,896 | 3,513,000 | 148.27 | |

| 2012 | 9,337 | 2,458 | 200,451 | 3,792,000 | 158.53 | |

| 2013 | 10,180 | 2,932 | 219,873 | 4,325,000 | 238.52 | 11,400 |

| 2014 | 11,081 | 3,294 | 239,792 | 4,651,895 | 289.80 | 12,200 |

| 2015 | 11,401 | 3,345 | 225,261 | 4,645,412 | 322.68 | 13,000 |

| 2016 | 12,261 | 3,168 | 220,177 | 5,147,852 | 334.16 | 13,000 |

| 2017 | 13,600 | 4,952 | 220,217 | 6,288,195 | 414.60 | 13,900 |

| 2018 | 14,198 | 4,305 | 159,573 | 5,975,818 | 14,900 |

Divisions

iShares

BlackRock’s largest division is iShares, a family of over 800 exchange-traded funds (ETFs) that comprises more than $1 trillion in assets under management. iShares is the largest provider of ETFs in the U.S. and in the world.

BlackRock Solutions

In 2000, BlackRock launched BlackRock Solutions, the analytics and risk management division of BlackRock, Inc. The division grew from the Aladdin System (which is the enterprise investment system), Green Package (which is the Risk Reporting Service) PAG (portfolio analytics) and AnSer (which is the interactive analytics). BlackRock Solutions (BRS) serves two roles within BlackRock. First, BlackRock Solutions is the in-house investment analytics and “process engineering” department for BlackRock which works with their portfolio management teams, risk and quantitative analysis, business operations and every other part of the firm that touches the investment process. Second, BlackRock Solutions (BRS) and the three primary divisions are services that offered to institutional clients. As of 2013, the platform had nearly 2,000 employees.[46]

BlackRock differentiates itself from other asset managers by claiming its risk management is not separate. Risk management is the foundation and cornerstone of the firm’s entire platform.[46] Aladdin keeps track of 30,000 investment portfolios, including BlackRock’s own along with those of competitors, banks, pension funds, and insurers. According to The Economist, as at December 2013, the platform monitors almost 7 percent of the world’s $225 trillion of financial assets.[46]

BlackRock Solutions was retained by the U. S. Treasury Department in May 2009[23] to manage the toxic mortgage assets (i.e. to analyze, unwind, and price) that were owned by Bear Stearns, AIG, Inc., Freddie Mac, Morgan Stanley, and other financial firms that were affected in the 2008 financial crisis.[47]

ESG investing

In 2017, BlackRock expanded its presence in sustainable investing and environmental, social and corporate governance (ESG) with new staff[48] and products both in USA[49] and Europe[50][51] with the aim to lead the evolution of the financial sector in this regard.[52]

BlackRock started using its weight to draw attention to environmental and diversity issues by means of official letters to CEOs and shareholder votes together with activist investors or investor networks[53] like the Carbon Disclosure Project, which in 2017 backed a successful shareholder resolution for ExxonMobil to act on climate change.[54][55] In 2018, it asked Russell 1000 companies to improve gender diversity on their board of directors if they had less than 2 women on them.[56]

After discussions with firearms manufacturers and distributors, on April 5, 2018, BlackRock introduced two new exchange-traded funds (ETFs) that exclude stocks of gun makers and large gun retailers, Walmart, Dick’s Sporting Goods, Kroger, Sturm Ruger, American Outdoor Brands Corporation, and Vista Outdoor, and removing the stocks from their seven existing environmental, social and corporate governance (ESG) funds, in order “to provide more choice for clients seeking to exclude firearms companies from their portfolios.”[57][58][59]

Contributions to global warming

Despite BlackRock’s attempts to model itself as a sustainable investor, one report shows that BlackRock is the world’s largest investor in coal plant developers, holding shares worth $11 billion among 56 coal plant developers.[60] Another report shows that BlackRock owns more oil, gas, and thermal coal reserves than any other investor with total reserves amounting to 9.5 gigatonnes of CO2 emissions – or 30 percent of total energy-related emissions from 2017.[61] Concerned about global warming, environmental groups including the Sierra Club,[62] and Amazon Watch [63] launched a campaign called BlackRock’s Big Problem in September 2018.[64] In this campaign, these groups assert that BlackRock is the “biggest driver of climate destruction on the planet”, due in part to its refusal to divest from fossil fuel companies.[64] On January 10th, 2020 a group of climate activists rushed inside the Paris offices of Black Rock France painting walls and floors with warnings and accusations on the responsibility of the company in the current climate and social crises.[65]

On January 14, 2020, BlackRock CEO Laurence Fink declared that environmental sustainability would be a key goal for investment decisions. BlackRock announced that it would sell $500 million worth of coal-related assets, and create funds that would avoid fossil-fuel stocks, two moves that would drastically shift the company’s investment policy.[41] Environmentalist Bill McKibben called this a “huge, if not final, win for activists.”[42]

Public perception

In his 2018 annual letter to shareholders, BlackRock CEO Laurence D. Fink stated that other CEOs should be aware of their impact on society, however, anti-war organizations are discontent with Fink’s statement,[66] because his company is the largest investor in weapon manufacturers through its iShares U.S. Aerospace and Defense ETF.[67] In May 2018, anti-war organizations held a demonstration[68] outside the annual BlackRock shareholder’s meeting in Manhattan, New York. In September 2018, an activist with the U.S. non-profit organization CODEPINK confronted Larry Fink on stage at the Yahoo Finance All Markets Summit.[69]

Key people

- Laurence D. Fink – Founder, Chairman & CEO

- Blake Grossman, former Vice Chairman

- Robert S. Kapito – Founder & Co-President

- Susan Wagner – Founder, member of the Board of Directors

See also

- Asset management in Singapore

- Charles Hallac

- Companies listed on the New York Stock Exchange (B)

- Socially responsible investing

- List of S&P 500 companies

- List of asset management firms

- List of CDO managers

- List of companies based in New York City

- List of hedge funds

- List of mutual-fund families in the United States

Notes

· BlackRock Financials (PDF), 2018, archived from the original (PDF) on 1 April 2019, retrieved 1 April 2019

· · BlackRock Financials (PDF), 2019, retrieved 17 February 2020

· · “About BlackRock”.

· · BlackRock’s Current Share Price Doesn’t Capture Its Long-Term Growth Prospects – Contacts and Office Locations, Forbes, retrieved July 26, 2017

· · “Die grösste Schattenbank der Welt”. Basler Zeitung. November 20, 2012. Retrieved May 8, 2017.

· · “Shadow and substance”. The Economist. May 10, 2014. Retrieved May 8, 2017.

· · Appell, Douglas; Appell, Douglas (2012-07-09). “BlackRock departures spur talk about Fink’s future”. Pensions & Investments. Retrieved 2019-04-15.

· · “The rise of BlackRock”. The Economist. 2013-12-05. ISSN 0013-0613. Retrieved 2019-04-15.

· · “Larry Fink Q&A: “I Don’t Identify as Powerful””. www.bloomberg.com. Retrieved 2019-04-15.

· · Carey, David; Morris, John E. (2012). King of Capital: The Remarkable Rise, Fall, and Rise Again of Steve Schwarzman and Blackstone. Crown Publishing Group. p. 59. ISBN 9780307886026.

· · “Schwarzman Says Selling BlackRock Was ‘Heroic’ Mistake”. Bloomberg.com. September 30, 2013. Retrieved 17 November 2016.

· · History, BlackRock, retrieved May 9, 2017

· · “BlackRock: The $4.3 trillion force”. Fortune. July 7, 2014. Retrieved May 9, 2017.

· · “Corporate History”. Archived from the original on May 17, 2012. Retrieved 2014-03-22.

· · “BlackRock Acquiring State Street Research from MetLife”. businesswire.com. August 24, 2004.

· · “BlackRock and a hard place”. The Economist. February 16, 2006. Retrieved May 9, 2017.

· · Spence, John. “BlackRock, Merrill fund unit complete merger”. MarketWatch. Retrieved 2019-04-11.

· · “BlackRock to Acquire Fund of Funds Business from Quellos Group, LLC” (PDF). 2007-06-26. BlackRock, Inc.

· · DeSilver, Drew (2007-06-27). “Quellos is selling unit to BlackRock in $1.72 billion deal”. The Seattle Times. Retrieved 2020-03-10.

· · Andrews, Suzanna. Larry Fink’s $12 Trillion Shadow, Vanity Fair, April 2010: “There is little doubt among the financial establishment in Washington and on Wall Street that BlackRock was the best choice to handle the government’s problems.”

· · “BlackRock to Acquire R3 Capital”. The New York Times. April 17, 2009. Retrieved May 9, 2017.

· · “US giant BlackRock buys arm of Barclays bank | The Guardian”. The Guardian. UK. Press Association. 12 June 2009. Retrieved 21 February 2010.

· · Kolhatkar, Sheelah (December 9, 2010). “Fink Builds BlackRock Powerhouse Without Goldman Sachs Backlash”. Bloomberg. Retrieved April 20, 2013.

· · “BlackRock to join S&P 500 index, replacing Genzyme”. Bloomberg Businessweek. 2011-03-29. Archived from the original on 2012-10-26. Retrieved January 23, 2012.

· · “Snapdeal raises $100M in fresh funding from BlackRock, Temasek, PremjiInvest, others”. VC Circle.

· · Rankin, Jennifer (December 15, 2014). “FCA bans £43,000 fare dodger from working in financial services” – via www.theguardian.com.

· · “FCA Life Ban For Fare-Dodging Jonathan Burrows”. Sky News. 15 December 2014. Retrieved 15 December 2014.

· · “Is BlackRock Too Big”. Sovereign Wealth Fund Institute. n.d. Archived from the original on 10 February 2015. Retrieved 9 February 2015.

· · “BlackRock profit falls as shift from stocks hits fee revenue”. Reuters. 2016-07-14. Retrieved 2019-01-15.

· · “BlackRock to Acquire FutureAdvisor”. BlackRock Press Releases. BlackRock. Retrieved 26 August 2015.

· · Tepper, Fitz (24 June 2015). “YC Alum FutureAdvisor Is Now Managing $600 Million In Assets”. TechCrunch. Retrieved 12 September 2015.

· · Stevenson, Alexandra (2015-11-18). “BlackRock to Wind Down Macro Hedge Fund”. The New York Times. ISSN 0362-4331. Retrieved 2015-11-19.

· · “BlackRock cuts ranks of stockpicking fund managers”. Financial Times. 27 March 2017. Retrieved 30 March 2017.

· · Hamilton, Peter (May 8, 2017). “BlackRock increases stakes in CRH and Bank of Ireland”. Irish Times. Retrieved May 8, 2017.

· · Foley, Stephen (April 19, 2017). “BlackRock assets under management hit $5.4tn on record ETF inflows”. Financial Times. Retrieved May 10, 2017.

· · Hughes, Jennifer (April 20, 2017). “BlackRock backs mainland China shares for MSCI benchmarks”. Financial Times. Retrieved May 10, 2017.

· · Deutsche Bank: Shareholder Structure, May 20, 2019

· · Deutsche Bank: Shareholder Structure at the Internet Archive, archived September 27, 2016

· · “World’s biggest investor accused of dragging feet on climate crisis”. May 21, 2019.

· · “Larry Fink’s Letter to CEOs”. BlackRock. Retrieved 2020-01-16.

· · Sorkin, Andrew Ross (2020-01-14). “BlackRock C.E.O. Larry Fink: Climate Crisis Will Reshape Finance”. The New York Times. ISSN 0362-4331. Retrieved 2020-01-16.

· · “BlackRock to sell $500 million in coal investments in climate change push”. www.cbsnews.com. Retrieved 2020-01-16.

· · “Annual Reports & Proxy Statements | BlackRock”. ir.blackrock.com. Retrieved 2018-11-18.

· · “BlackRock”. Fortune. Retrieved 2018-11-25.

· · “BlackRock – Verwaltetes Vermögen bis 2017 | Statistik”. Statista (in German). Retrieved 2018-10-30.

· · Briefing: BlackRock – The Monolith And The Markets, The Economist, December 7, 2013, pp. 24-26.

· · Rappaport, Liz; Craig, Susanne (2009-05-19). “BlackRock Wears Multiple Hats”. Wall Street Journal. ISSN 0099-9660. Retrieved 2019-01-24.

· · Chasan, Emily (2017-10-10). “BlackRock Names Former Obama Aide to Run Sustainable Investing”. Bloomberg.

· · Jarsh, Melissa; Chasan, Emily (2018-06-13). “BlackRock, Wells Fargo Are Betting on Ethical Investing Funds for 401(k)s”. Bloomberg.

· · Camilla Giannoni (2018-10-19). “BlackRock hires new Switzerland CEO”. deepen our commitment to clients in Switzerland and broaden our sustainable investing footprint in Europe

· · “Independent Capital’s Staub-Bisang to run BlackRock Switzerland”. Reuters. 2018-10-19.

· · “BlackRock stakes claim on ‘sustainable investing’ revolution”. Financial Times. 2018-10-22. BlackRock intends to become a global leader in “sustainable investing”, says Larry Fink, as the world’s largest asset manager launched

· · Andrew Winston (2018-01-19). “Does Wall Street Finally Care About Sustainability?”. HBR.

· · Tarek Soliman (2017-06-01). “The new normal: Exxon shareholders vote in favour of climate action”.

· · Gary McWilliams (2017-05-31). “Exxon shareholders approve climate impact report in win for activists”. Reuters.

· · Chasan, Emily (2018-11-03). “BlackRock Is Sick of Excuses for Corporate Boards Lacking Women”. Bloomberg.

· · Moyer, Liz (April 5, 2018). “BlackRock to offer new funds that exclude stocks of gun makers and retailers including Walmart”. CNBC. Retrieved April 2, 2019.

· · Gibson, Kate (April 5, 2018). “BlackRock unveils line of gun-free investment products”. CBS News. Retrieved April 2, 2019.

· · Siegel, Rachel (April 6, 2018). “BlackRock unveils gun-free investment options”. The Washington Post. Retrieved April 2, 2019.

· · “New Research Reveals the Banks and Investors Financing the Expansion of the Global Coal Plant Fleet”. Urgewald. 2018-12-05.

· · “New report confirms BlackRock’s big fossil fuel problem”. Friends of the Earth. 2018-12-10.

· · “New Campaign Is Calling Out BlackRock’s Big Climate Problem”. Sierra Club. 2018-10-05. Retrieved 2019-01-24.

· · “BlackRock Targeted as Largest Driver of Climate Destruction in New Campaign”. Amazon Watch. Retrieved 2019-01-24.

· · “BlackRock’s Big Problem | Making the climate crisis worse”. BlackRock’s Big Problem | Making the climate crisis worse. Retrieved 2019-01-24.

· · “BlackRock’s Paris Office Barricaded by Climate Activists”. Retrieved 2020-02-10.

· · Gjording, Lindsey Rae (January 23, 2018). “Larry Fink calls on CEOs to realize their companies’ social responsibility”. DW.com. Archived from the original on November 3, 2019. Retrieved November 3, 2019.

· · BlackRock, Inc. (2019). “iShares U.S. Aerospace & Defense ETF”. BlackRock. Archived from the original on November 3, 2019. Retrieved November 3, 2019.

· · Marcus, Shapiro, Chelsea Rose, Rich (May 23, 2018). “Anti-gun protesters rally outside BlackRock shareholder meeting to condemn its Sturm Ruger investments”. New York Daily News. Archived from the original on November 3, 2019. Retrieved November 3, 2019.

- · English, Carleton (September 20, 2018). “Larry Fink blitzed by war protesters at conference”. New York Post. Archived from the original on November 3, 2019. Retrieved November 3, 2019.

Further reading

- Brooker, Katrina (October 29, 2008). “Can this man save Wall Street?”. Fortune.

- Foley, Stephen (April 2, 2017). “BlackRock’s active funds navigate rough seas”. Financial Times.

- BlackRock

- 1988 establishments in New York (state)

- Companies based in Manhattan

- Companies listed on the New York Stock Exchange

- Financial services companies based in New York City

- Financial services companies established in 1988

- Investment management companies of the United States

- Multinational companies based in New York City

- Publicly traded companies based in New York City

- 1999 initial public offerings

The Blackstone Group

From Wikipedia, the free encyclopedia

Jump to navigation Jump to search

Not to be confused with Trammell Crow Company Inc, a development firm owned by CBRE Group.

| The Blackstone Group Inc. | |

| Type | Public |

| Traded as | NYSE: BX |

| ISIN | US09253U1088 |

| Industry | Financial services |

| Founded | 1985; 35 years ago |

| Founder | Peter George Peterson Stephen A. Schwarzman |

| Headquarters | 345 Park Avenue, Manhattan, New York City, New York , United States |

| Key people | Stephen A. Schwarzman (chairman and CEO) Jonathan D. Gray (president and COO) Hamilton E. James (executive vice chairman) Byron Wien (vice chairman of Blackstone Advisory Partners) |

| Products | Private equity Investment management Asset management |

| Revenue | |

| Operating income | |

| Net income | |

| AUM | |

| Total assets | |

| Number of employees | 2,360[2] (2017) |

| Subsidiaries | Hilton Worldwide Merlin Entertainments Group Euro Garages |

| Website | www.blackstone.com |

| Footnotes / references [3] |

The Blackstone Group Inc. is an American multinational private equity, alternative asset management, and financial services firm based in New York City. As the largest alternative investment firm in the world,[4] Blackstone specializes in private equity, credit, and hedge fund investment strategies.[5]

Blackstone’s private equity business has been one of the largest investors in leveraged buyouts in the last decade, while its real estate business has actively acquired commercial real estate. Since its inception, Blackstone has invested in such notable companies as Hilton Worldwide, Merlin Entertainments Group, Performance Food Group, EQ Office, Republic Services, AlliedBarton, United Biscuits, Freescale Semiconductor, Vivint,[6], and Travelport.[7]

Blackstone was founded in 1985 as a mergers and acquisitions boutique by Peter G. Peterson and Stephen A. Schwarzman, who had previously worked together at Lehman Brothers. In 2007, Blackstone became a public company via a $4 billion initial public offering to become one of the first major private equity firms to list shares in its management company on the public stock market.[8] Blackstone is headquartered at 345 Park Avenue in Manhattan, New York City, with eight additional offices in the United States, as well as offices in London, Paris, Dublin, Düsseldorf, Luxembourg, Sydney, Tokyo, Hong Kong, Singapore, Beijing, Shanghai, Mumbai, and Dubai.[9]

As of 2019, the company’s total assets under management were approximately US$545 billion dollars.[10]:14 In April 2019, Blackstone disclosed it was converting to a corporation from a publicly traded partnership.[11]

Contents

- 1 History

- 2 Operations

- 3 Criticism and controversies

- 4 Leadership

- 5 See also

- 6 References

- 7 External links

History

Founding and early history

The Blackstone Group was founded in 1985 by Peter G. Peterson and Stephen A. Schwarzman with $400,000 in seed capital.[12][13] The founders named their firm “Blackstone”, which was a cryptogram derived from the names of the two founders (Schwarzman and Peterson): “Schwarz” is German for “black”; “Peter”, or “Petra” in Greek, means “stone” or “rock”.[14] The two founders had previously worked together at Lehman Brothers. At Lehman, Schwarzman served as head of Lehman Brothers’ global mergers and acquisitions business.[15] Prominent investment banker Roger C. Altman, another Lehman veteran, left his position as a managing director of Lehman Brothers to join Peterson and Schwarzman at Blackstone in 1987, but left in 1992 to join the Clinton Administration as Deputy Treasury Secretary.

Blackstone was originally formed as a mergers and acquisitions advisory boutique. Blackstone advised on the 1987 merger of investment banks E. F. Hutton & Co. and Lehman Brothers, collecting a $3.5 million fee.[16][17]

Blackstone co-founder Peter Peterson was former chairman and CEO of Lehman Brothers

From the outset in 1985, Schwarzman and Peterson planned to enter the private equity business, but had difficulty in raising their first fund because neither had ever led a leveraged buyout.[18] Blackstone finalized fundraising for its first private equity fund in the aftermath of the October 1987 stock market crash. After two years of providing strictly advisory services, Blackstone decided to pursue a merchant banking model after its founders determined that many situations required an investment partner rather than just an advisor. The largest investors in the first fund included Prudential Insurance Company, Nikko Securities and the General Motors pension fund.[19]

Blackstone also ventured into other businesses, most notably investment management. In 1987 Blackstone entered into a 50–50 partnership with the founders of BlackRock, Larry Fink and Ralph Schlosstein. The two founders, who had previously run the mortgage-backed securities divisions at First Boston and Lehman Brothers, respectively, initially joined Blackstone to manage an investment fund and provide advice to financial institutions. They also planned to use a Blackstone fund to invest in financial institutions and help build an asset management business specializing in fixed income investments.[20][21]

As the business grew, Japanese bank Nikko Securities acquired a 20% interest in Blackstone for a $100 million investment in 1988 (valuing the firm at $500 million). Nikko’s investment allowed for a major expansion of the firm and its investment activities.[22] The growth firm also recruited politician and investment banker David Stockman from Salomon Brothers in 1988. Stockman led many key deals in his time at the firm, but had a mixed record with his investments.[23] He left Blackstone in 1999 to start his own private equity firm, Heartland Industrial Partners, based in Greenwich, Connecticut.[24][25]

The firm advised CBS Corporation on its 1988 sale of CBS Records to Sony to form what would become Sony Music Entertainment.[26] In June 1989, Blackstone acquired freight railroad operator, CNW Corporation.[27] That same year, Blackstone partnered with Salomon Brothers to raise $600 million to acquire distressed thrifts in the midst of the savings and loan crisis.[28]

1990s

The Blackstone Group logo in use prior to the firm’s rebranding as simply Blackstone

As the 1990s began, Blackstone continued its growth and expansion into new businesses. In 1990, Blackstone launched its fund of hedge funds business, initially intended to manage investments for Blackstone senior management. Also in 1990, Blackstone extended its ambitions to Europe, forming a partnership with J. O. Hambro Magan in the UK and Indosuez in France. In 1991, Blackstone created its Europe unit to enhance the firm’s presence internationally.[29][30]

In 1991, Blackstone launched its real estate investment business with the acquisition of a series of hotel businesses under the leadership of Henry Silverman. In 1990, Blackstone and Silverman acquired a 65% interest in Prime Motor Inn’s Ramada and Howard Johnson franchises for $140 million, creating Hospitality Franchise Systems as a holding company.[31] In October 1991, Blackstone and Silverman added Days Inns of America for $250 million.[32] Then, in 1993, Hospitality Franchise Systems acquired Super 8 Motels for $125 million.[33] Silverman would ultimately leave Blackstone to serve as CEO of HFS, which would later become Cendant Corporation.

Blackstone made a number of notable investments in the early and mid-1990s, including Great Lakes Dredge and Dock Company (1991), Six Flags (1991), US Radio (1994), Centerplate (1995), MEGA Brands (1996). Also, in 1996, Blackstone partnered with the Loewen Group, the second largest funeral home and cemetery operator in North America, to acquire funeral home and cemetery businesses. The partnership’s first acquisition was a $295 million buyout of Prime Succession from GTCR.[34][35][36]

In 1995, Blackstone sold its stake in BlackRock to PNC Financial Services for $250 million. Between 1995 and 2014, PNC reported $12 billion in pretax revenues and capital gains from BlackRock, Schwarzman later described the selling of BlackRock as his worst business decision ever.[37]

Through the mid and late 1990s, Blackstone continued to grow. In 1997, Blackstone completed fundraising for its third private equity fund, with approximately $4 billion of investor commitments[38] and a $1.1 billion real estate investment fund.[39] In the following year, in 1998, Blackstone sold a 7% interest in its management company to AIG, replacing Nikko Securities as its largest investor and valuing Blackstone at $2.1 billion.[40] Then, in 1999, Blackstone launched its mezzanine capital business. Blackstone brought in five professionals, led by Howard Gellis from Nomura Holding America’s Leveraged Capital Group to manage the business.[41]

Blackstone’s investments in the late 1990s included AMF Group (1996), Haynes International (1997), American Axle (1997), Premcor (1997), CommNet Cellular (1998), Graham Packaging (1998), Centennial Communications (1999), Bresnan Communications (1999), PAETEC Holding Corp. (1999). Haynes and Republic Technologies International, a specialty steel maker in which Blackstone invested in 1996, both had problems and ultimately filed bankruptcy.[42]

Also, in 1997, Blackstone made its first investment in Allied Waste. Two years later, in 1999, Blackstone, together with Apollo Management provided capital for Allied Waste’s acquisition of Browning-Ferris Industries in 1999 to create the second largest waste management company in the US. Blackstone’s investment in Allied was one of its largest to that point in the firm’s history.[43]

Its investments in telecommunications businesses—four cable TV systems in rural areas (TW Fanch 1 and 2, Bresnan Communications and Intermedia Partners IV) and a cell phone operator in the Rocky Mountain states (CommNet Cellular) were among the most successful of the era, generating $1.5 billion of profits for Blackstone’s funds.[44]

Blackstone Real Estate Advisers, its real estate affiliate, bought the Watergate Complex in Washington D.C. in July 1998 for $39 million[45] and sold it to Monument Reality in August 2004.[46]

Early 2000s

Blackstone acquired the mortgage for 7 World Trade Center in October 2000 from the Teachers Insurance and Annuity Association.[47]

Schwarzman’s Blackstone Group completed the first major IPO of a private equity firm in June 2007.[48]

In July 2002, Blackstone completed fundraising for a $6.45 billion private equity fund, Blackstone Capital Partners IV, the largest private equity fund ever raised to that point. More than $4 billion of the capital was raised by the end of 2001 and Blackstone was able to secure the remaining commitments despite adverse market conditions.[49]

With a significant amount of capital in its new fund, Blackstone was one of a handful of private equity investors capable of completing large transactions in the adverse conditions of the early 2000s recession. At the end of 2002, Blackstone, together with Thomas H. Lee Partners and Bain Capital, acquired Houghton Mifflin Company for $1.28 billion. The transaction represented one of the first large club deals completed since the collapse of the Dot-com bubble.[50]

In 2002, Hamilton E. James joined global alternative asset manager Blackstone, where he currently serves as president and chief operating officer. He also serves on the firm’s executive and management committees, and its board of directors.[51] In late 2002, Blackstone remained active acquiring TRW Automotive in a $4.7 billion buyout, the largest private equity deal announced that year (the deal was completed in early 2003). TRW’s parent was acquired by Northrop Grumman, while Blackstone purchased its automotive parts business, a major supplier of automotive systems.[52][53] Blackstone also purchased a majority interest in Columbia House, a music-buying club, in mid-2002.[54]

Blackstone made a significant investment in Financial Guaranty Insurance Company (FGIC), a monoline bond insurer alongside PMI Group, The Cypress Group and CIVC Partners. FGIC incurred heavy losses, along with other bond insurers in the 2008 credit crisis.[55]

Two years later, in 2005, Blackstone was one of seven private equity firms involved in the buyout of SunGard in a transaction valued at $11.3 billion. Blackstone’s partners in the acquisition were Silver Lake Partners, Bain Capital, Goldman Sachs Capital Partners, Kohlberg Kravis Roberts, Providence Equity Partners, and TPG Capital. This represented the largest leveraged buyout completed since the takeover of RJR Nabisco at the end of the 1980s leveraged buyout boom. Also, at the time of its announcement, SunGard would be the largest buyout of a technology company in history, a distinction it would cede to the buyout of Freescale Semiconductor. The SunGard transaction is also notable in the number of firms involved in the transaction, the largest club deal completed to that point.[56] The involvement of seven firms in the consortium was criticized by investors in private equity who considered cross-holdings among firms to be generally unattractive.[57][58]

In 2006, Blackstone launched its long / short equity hedge fund business, Kailix Advisors. According to Blackstone, as of September 30, 2008, Kailix Advisors had $1.9 billion of assets under management. In December 2008, Blackstone announced that Kailix would be spun off to its management team to form a new fund as an independent entity backed by Blackstone.[59]

While Blackstone was active on the corporate investment side, it was also busy pursuing real estate investments. Blackstone acquired Prime Hospitality[60] and Extended Stay America in 2004. Blackstone followed these investments with the acquisition of La Quinta Inns & Suites in 2005. Blackstone’s largest transaction, the $26 Billion buyout of Hilton Hotels Corporation occurred in 2007 under the tenure of Hilton CFO Stephen Bollenbach.[61] Extended Stay Hotels was sold to The Lightstone Group in July 2007 and Prime Hospitality’s Wellesley Inns were folded into La Quinta.[62] La Quinta Inns & Suites went public in 2014 and is now controlled by La Quinta Holdings as the parent organization.[63]

Buyouts (2005–2007)

During the buyout boom of 2006 and 2007, Blackstone completed some of the largest leveraged buyouts. Blackstone’s most notable transactions during this period included the following:

| Investment | Year | Company Description | Ref. |

| TDC | 2005 | In December 2005, Blackstone together with a group of firms, including Kohlberg Kravis Roberts, Permira, Apax Partners and Providence Equity Partners, acquired Tele-Denmark Communications. The firms acquired the former telecom monopoly in Denmark, under the banner Nordic Telephone Company (NTC) for approximately $11 billion. | [64] |

| EQ Office | 2006 | Blackstone completed the $37.7 billion acquisition of one of the largest owners of commercial office properties in the US. At the time of its announcement, the EQ Office buyout became the largest in history, surpassing the buyout of Hospital Corporation of America. It would later be surpassed by Kohlberg Kravis Roberts‘s buyout of TXU. Vornado Realty Trust bid against Blackstone, pushing up the final price. | [65][66] |

| Freescale Semiconductor | A consortium led by Blackstone and including the Carlyle Group, Permira and the TPG Capital completed the $17.6 billion takeover of the semiconductor company. At the time of its announcement, Freescale would be the largest leveraged buyout of a technology company ever, surpassing the 2005 buyout of SunGard. The buyers were forced to pay an extra $800 million because KKR made a last minute bid as the original deal was about to be signed. Shortly after the deal closed in late 2006, cell phone sales at Motorola Corp., Freescale’s former corporate parent and a major customer, began dropping sharply. In addition, in the recession of 2008–2009, Freescale’s chip sales to automakers fell off, and the company came under great financial strain. | [67][68] | |

| Michaels | Blackstone, together with Bain Capital, acquired Michaels, the largest arts and crafts retailer in North America in a $6.0 billion leveraged buyout in October 2006. Bain and Blackstone narrowly beat out Kohlberg Kravis Roberts and TPG Capital in an auction for the company. | [69] | |

| Nielsen Holdings | Blackstone together with AlpInvest Partners, Carlyle Group, Hellman & Friedman, Kohlberg Kravis Roberts and Thomas H. Lee Partners acquired the global information and media company formerly known as VNU. | [70][71][72] | |

| Orangina[73] | Blackstone, together with Lion Capital acquired Orangina, the bottler, distributor and franchisor of a number of carbonated and other soft drinks in Europe from Cadbury Schweppes for €1.85 billion | [74] | |

| Travelport | Travelport, the parent of the travel web site Orbitz.com, was acquired from Cendant by Blackstone and Technology Crossover Ventures in a deal valued at $4.3 billion. The sale of Travelport followed the spin-offs of Cendant’s real estate and hospitality businesses, Realogy Corporation and Wyndham Worldwide Corporation, respectively, in July 2006. (Later in the year, TPG and Silver Lake would acquire Travelport’s chief competitor Sabre Holdings.) Soon after the Travelport buyout, Travelport spun off part of its subsidiary Orbitz Worldwide in an IPO and bought a Travelport competitor, Worldspan. | [7] | |

| United Biscuits | In October 2006 Blackstone, together with PAI Partners announced the acquisition of the British biscuit producer. The deal was completed in December 2006. | [75][76] | |

| RGIS Inventory Specialists | 2007 | In March 2007, RGIS announced that Blackstone Group purchased a controlling interest in the company, the terms of the transaction were not disclosed. | [77] |

| Biomet | Blackstone, Kohlberg Kravis Roberts, TPG Capital and Goldman Sachs Capital Partners acquired Biomet, a medical device manufacturer for $10.9 billion. | [78] | |

| Hilton Worldwide | Blackstone acquired the premium hotel operator for approximately $26 billion, representing a 25% premium to Hilton’s all-time high stock price. The Hilton deal, announced on July 3, 2007 is often referred to as the deal that marked the “high water mark” and the beginning of the end of the multi-year boom in leveraged buyouts. The company restructured its debt in 2010. | [79][80][81] |

Initial public offering in 2007

In 2004, Blackstone had explored the possibility of creating a business development company (BDC), Blackridge Investments, similar to vehicles pursued by Apollo Management.[82] However, Blackstone failed to raise capital through an initial public offering that summer, and the project was shelved.[83] It also planned to raise a fund on the Amsterdam stock exchange in 2006, but its rival, Kohlberg Kravis Roberts & Co., launched a $5 billion fund there that soaked up all demand for such funds, and Blackstone abandoned its project.[84]

In 2007, Blackstone acquired Alliant Insurance Services, an insurance brokerage firm. The company was sold to Kohlberg Kravis Roberts in 2012.[85]

On June 21, 2007, Blackstone became a public company via an initial public offering, selling a 12.3% stake in the company for $4.13 billion, in the largest U.S. IPO since 2002.[8][86]

2008 to 2010

During the financial crisis of 2007–2008, Blackstone managed to close only a few transactions. In January 2008, Blackstone made a small co-investment alongside TPG Capital and Apollo Management in their buyout of Harrah’s Entertainment, although that transaction had been announced during the buyout boom period. Other notable investments that Blackstone completed in 2008 and 2009 included AlliedBarton, Performance Food Group,[87][88] Apria Healthcare and CMS Computers.

In July 2008, Blackstone, together with NBC Universal and Bain Capital acquired The Weather Channel from Landmark Communications for $3.5 billion. In 2015, the digital assets were sold to IBM for $2 billion. In 2018, the remainder of the company was sold to Byron Allen for $300 million.[89]

In December 2009, Blackstone acquired Busch Entertainment Corporation from Anheuser-Busch InBev for $2.9 billion.[90]

In November 2013, Merlin Entertainments, owned in part by Blackstone Group, became a public company via an initial public offering on the London Stock Exchange.[91][92]

In August 2010, Blackstone announced it would buy Dynegy, an energy firm, for nearly $5 billion; however, the acquisition was terminated in November 2010.[93]

Investments 2011 to 2015

- In February 2011, the company acquired Centro Properties Group US from Centro Retail Trust (now Vicinity Centres) for $9.4 billion.[94] The company became Brixmor Property Group and Blackstone sold its remaining interest in the company in August 2016.[95]

- In November 2011, a fund managed by the company acquired medical biller Emdeon for $3 billion.[96]

- In late 2011, Blackstone Group LP acquired Jack Wolfskin, a German camping equipment company. In 2017, the company was handed over to its lenders.[97]

- In August 2012, Blackstone was part of a consortium that financed Knight Capital after a software glitch threatened Knight’s ability to continue operations.[98]

- In October 2012, the company acquired G6 Hospitality, operator of Motel 6 & Studio 6 motels from AccorHotels, for $1.9 billion.[99]

- In November 2012, the company acquired a controlling interest in Vivint, Vivint Solar, and 2GIG Technologies.[100] In February 2013, 2GIG was flipped to Nortek Security & Control, LLC for $135M.[101]

- In April 2013, the company discussed buying Dell, but it did not pursue the acquisition.[102]

- In June 2013, Blackstone Real Estate Partners VII acquired an industrial portfolio from First Potomac Realty Trust for $241.5 million.[103] Part of this portfolio was developed by StonebridgeCarras as Oakville Triangle (Now “National Landing“)[104]

- In September 2013, Blackstone announced a strategic investment in ThoughtFocus Technologies LLC, an information technology service provider.[105]

- In August 2013, Blackstone acquired Strategic Partners, manager of secondaryfunds, from Credit Suisse.[106]

- In February 2014, Blackstone purchased a 20% stake in the Italian luxury brand Versace for €150 million.[107][108]

- In April 2014, Blackstone’s charitable arm, the Blackstone Charitable Foundation, donated $4 million to create the Blackstone Entrepreneurs Network in Colorado. The program encourages increased collaboration among local business leaders with the goal of retaining high-growth companies in the state.[109]

- In May 2014, Blackstone Group acquired the Cosmopolitan of Las Vegas resort from Deutsche Bank for $1.73 billion.[110]

- In August 2014, Blackstone Energy Partners acquired Shell Oil‘s 50% stake in a shale-gas field in the Haynesville Shale for $1.2 billion.[111]

- In January 2015, Blackstone Real Estate Partners VI announced it would sell a Gold Fields House in Sydney to Dalian Wanda Group for A$415 million.[112]

- In June 2015, Blackstone acquired the Willis Tower in Chicago for $1.3 billion.[113]

- In July 2015, Blackstone acquired Excel Trust, a real estate investment trust, for around $2 billion.[114]

- In November 2015, the company agreed to sell facility management firm GCA Services Group to Goldman Sachs and Thomas H. Lee Partners.[115]

Investments since 2016

- In January 2016, Blackstone Real Estate Partners VIII L.P. acquired BioMed Realty Trust for $8 billion.[116]

- In February 2016, Blackstone sold four office buildings to Douglas Emmett for $1.34 billion.[117]

- In April 2016, Blackstone acquired 84 percent of Hewlett-Packard Enterprise‘s stake in the Indian IT services firm Mphasis.[118]

- On January 4, 2017, Blackstone acquired SESAC, a music-rights organization.[119]

- On February 10, 2017, Aon PLC agreed to sell its human resources outsourcing platform for $4.3 billion to Blackstone Group L.P.,[120] creating a new company called Alight Solutions.[121]

- On June 19, 2017, Blackstone acquired a majority interest in The Office Group, valuing the company at $640 million.[122]

- In July 2017, the company announced an investment in Leonard Green & Partners.

- In January 2018, the company acquired Pure Industrial, a Canadian real estate investment trust for C$2.5 billion.[123]

- In January 2018, the company announced acquisition agreement for 55% of Thomson Reuters Financial & Risk unit for $20 billion.[124]

- In March 2018, Blackstone Real Estate Income Trust, Inc. acquired a 22 million square foot portfolio of industrial properties from Cabot Properties for $1.8 billion.[125][126]

- In March 2018, Blackstone’s Strategic Capital Holdings Fund invested in Rockpoint Group.[127]

- In March 2018, the company’s Strategic Capital Holdings Fund announced an investment in Kohlberg & Company, a private equity firm.[128]

- In September 2018, the company acquires control of Luminor Bank in the Baltic countries.[129]

- In October 2018, Blackstone launched Refinitiv, the company resulting from its January deal for a 55 per-cent stake in Thomson Reuters Financial and Risk business.[130]

- In October 2018, Blackstone announced to buy Clarus. The deal includes assets worth $2.6 billion.[131]

- In March 2019, Blackstone purchased a minority stake in YES Network.[132]

- In June 2019, Blackstone announced it had teamed with the Canada Pension Plan Investment Board and KIRKBI to buy Merlin Entertainment, the owners of Legoland in a deal worth £5.9 billion (about $7.5 billion). This would be the 2nd time Blackstone would own the company as they previously purchased it in 2005. [133]

- On July 15, 2019, Blackstone announced its plans to acquire Vungle, a leading mobile performance marketing platform.[134]

- In September 2019, Blackstone announced it agreed to purchase 65% controlling interest in Great Wolf Resorts from Centerbridge Partners. They plan to form a joint venture worth $2.9 billion or more to own the company.[135]

- On November 8, 2019, Blackstone Group acquired a majority stake MagicLab, the owner of dating app Bumble.[136]

- Blackstone Group on November 15, 2019, invested $167 million in the holding company of Future Lifestyle Fashions Ltd., Ryka Commercial Ventures Pvt. Ltd.[137]

- On November 18, 2019, Blackstone Real Estate Income Trust, Inc. acquired the Bellagio resort in Las Vegas, Nevada from MGM Resorts in a sale-leaseback transaction.[138]

- On November 25, 2019, Reuters reported that Blackstone planned to invest $400 million in a joint venture with Swiss drug company Ferring. The joint venture will be working on gene therapy for bladder cancer, and the investment represents Blackstone Group’s largest investment in drug development to date.[139]

- In March 2020, Blackstone announced that it is buying a majority stake in HealthEdge, a health-care software company.[140]

Operations

Blackstone operates through four primary departments: private equity; real estate; hedge funds; and credit.[20][3]

Corporate private equity

Employees: 250 (approximate)

As of 2019, Blackstone was the world’s largest private equity firm by capital commitments as ranked by Private Equity International.[141] The firm invests through minority investments, corporate partnerships, and industry consolidations, and occasionally, start-up investments. The firm focuses on friendly investments in large capitalization companies.[20]

Blackstone has primarily relied on private equity funds, pools of committed capital from pension funds, insurance companies, endowments, fund of funds, high-net-worth individuals, sovereign wealth funds, and other institutional investors.[142] From 1987 to its IPO in 2007, Blackstone invested approximately $20 billion in 109 private equity transactions.[20]

Blackstone’s most notable investments include Allied Waste,[43] AlliedBarton Security Services, Graham Packaging, Celanese, Nalco, HealthMarkets, Houghton Mifflin, American Axle, TRW Automotive, Catalent Pharma Solutions, Prime Hospitality, Legoland, Madame Tussauds,[143] Luxury Resorts (LXR), Pinnacle Foods, Hilton Hotels Corporation, Motel 6, Apria Healthcare, Travelport, The Weather Channel (United States) and The PortAventura Resort. In 2009 Blackstone purchased Busch Entertainment (comprising the Sea World Parks, Busch Garden Parks and the two water parks).[144]

In 2012, Blackstone acquired a controlling interest in Utah-based Vivint, Inc., a home automation, security, and energy company.[145]

Real estate

Employees: 500 (approximate)

Blackstone’s most notable real estate investments have included EQ Office, Hilton Hotels Corporation, Trizec Properties, Center Parcs UK, La Quinta Inns & Suites, Motel 6, Wyndham Worldwide, Southern Cross Healthcare and Vicinity Centres.[146]

The purchase and subsequent IPO of Southern Cross led to controversy in the UK. Part of the purchase involved splitting the business into a property company, NHP, and nursing home business, which Blackstone claimed would become “the leading company in the elderly care market”. In May 2011, Southern Cross, now independent, was almost bankrupt, jeopardising 31,000 elderly residents in 750 care homes. It denied blame, although Blackstone was widely accused in the media for selling on the company with an unsustainable business model and crippled with an impossible sale and leaseback strategy.[147][148]

After the subprime mortgage crisis, Blackstone Group LP bought more than $5.5 billion worth of single-family homes to rent, and then be sold when the prices rise.[149]

In 2014, Blackstone sold Northern California office buildings[which?] for $3.5 billion.[150]

In 2018, critique was raised regarding a purchase agreement on several hundred apartments in Frederiksberg, Denmark, between Blackstone’s Danish partner North 360 and Frederiksberg Boligfond, a non-profit housing organization established by Frederiksberg Municipality in 1930. After resistance of residents and questions regarding the legality of the purchase agreement, Blackstone withdrew from it in October 2019.[151]

Marketable alternative asset management

In 1990, Blackstone created a fund of hedge funds business to manage internal assets for Blackstone and its senior managers. This business evolved into Blackstone’s marketable alternative asset management segment, which was opened to institutional investors. Among the investments included in this segment are funds of hedge funds, mezzanine funds, senior debt vehicles, proprietary hedge funds and closed-end mutual funds.[20]

In March 2008, Blackstone acquired GSO Capital Partners, a credit-oriented alternative asset manager, for $620 million in cash and stock and up to $310 million through an earnout over the next five years based on certain earnings targets. The combined entity created one of the largest credit platforms in the alternative asset management business, with over $21 billion under management.[152] GSO was founded in 2005 by Bennett Goodman, Tripp Smith, and Doug Ostrover. The GSO team had previously managed the leveraged finance businesses at Donaldson, Lufkin & Jenrette and later Credit Suisse First Boston, after they acquired DLJ. Blackstone had been an original investor in GSO’s funds. Following the acquisition, Blackstone merged GSO’s operations with its existing debt investment operations.[153][59]

Criticism and controversies

CEO and co-founder Stephen A. Schwarzman has been criticised for his long-time association with now U.S. President Donald Trump. Recently, he served as chair of his Strategic and Policy Forum until its dissolution and has donated around $850,000 to Trump’s inauguration and political action committees since his victory in the 2016 U.S. presidential election, on top of $5.5 million to Republicans in the preceding election cycle.[154][155][156]

In separate cases in 2018 and 2019, the hotel chain Motel 6, which is owned by Blackstone, agreed to settle for a total of $19.6 million for giving guest lists to U.S. Immigration and Customs Enforcement (ICE) without a warrant.[157][158]

In 2019, The Intercept revealed that two firms owned by Blackstone were partially responsible for the burning of the Amazon rainforest.[159][160]

United Nations housing rapporteur Leilani Farha and Surya Deva, chair of the UN Working Group on Business and Human Rights, have criticised Blackstone’s business practices, including frequent rent increases and “aggressive” evictions, for contributing to the global housing crisis.[161] Blackstone disputes these claims.

Leadership

Executives

- Stephen A. Schwarzman: chairman, CEO & co-founder

- Jonathan D. Gray: president & COO

- Hamilton E. James: executive vice chairman

- J. Tomilson Hill: vice chairman & chairman of the Hedge Fund Solutions group, Blackstone Alternative Asset Management (BAAM)

- Joseph Baratta: Global Head of private equity

- David S. Blitzer: Global Head of tactical opportunities

- Jonathan Korngold: Global Head of growth equity

- David L. Calhoun: head of private equity portfolio operations

- Kenneth Caplan: global co-head of real estate

- Michael S. Chae: CFO

- Bennett J. Goodman: co-founder of GSO Capital Partners

- John G. Finley: CLO

- Kathleen McCarthy: global co-head of real estate

- Joan Solotar: head of private wealth solutions & external relations

Board of directors

- Stephen A. Schwarzman: chairman of the board of directors and the executive committee

- Hamilton E. James: member of the executive committee

- Jonathan D. Gray: member of the executive committee

- J. Tomilson Hill: member of the executive committee

- Bennett J. Goodman: member of the executive committee

- James W. Breyer: independent director & member of the audit committee and the conflicts committee

- Rochelle B. Lazarus: independent director & member of the audit committee and the conflicts committee

- Jay O. Light: independent director & member of the audit committee and the conflicts committee

- The Right Honorable Brian Mulroney: independent director

- William G. Parrett: independent director & chairman of the audit committee and the conflicts committee

See also

References

· https://www.blackstone.com/the-firm/

· · “Blackstone Group”. Fortune. Retrieved 2018-12-21.

· · “The Blackstone Group L.P. 2017 Form 10-K Annual Report”. U.S. Securities and Exchange Commission.

· · Wiliam Alden (April 18, 2013). “Public Offering Values SeaWorld at $2.5 Billion”. The New York Times. Retrieved April 19, 2013.

· · “The Blackstone Group”. The New York Times. Retrieved 12 January 2016.

· · Kim, Soyoung (September 19, 2012). “Blackstone buys security firm Vivint for over $2 billion”. Reuters. Retrieved 2013-03-23.

· · Deutch, Claudia H. (July 1, 2006). “Blackstone Plans to Acquire Cendant Travel Services Unit”. The New York Times.

· · Anderson, Jenny. “Blackstone Founders Prepare to Count Their Billions.” The New York Times, June 12, 2007.

· · “Blackstone – Our Offices overview”. Blackstone.

· · Blackstone Group L.P. (Jan 31, 2019). Form 8K: Blackstone Reports Fourth Quarter and Full Year 2018 Results (PDF) (Report). United States Securities and Exchanges Commission. Retrieved Feb 5, 2019.

· · “Blackstone is Converting to a Corporation”. Sovereign Wealth Fund Institute. April 19, 2019. Retrieved April 19, 2019.

· · David Carey and John E. Morris, King of Capital: The Remarkable Rise, Fall and Rise Again of Steve Schwarzman and Blackstone (Crown 2010), pp. 45–56

· · Private equity power list: #1 The Blackstone Group Archived 2009-02-28 at the Wayback Machine. Fortune, July 2, 2007

· · Blackstone etymology[permanent dead link]. The Deal, June 26, 2007

· · Alden, William. “Blackstone’s Chief Has a Warning for Wall Street’s Entrepreneurs”. DealBook. Retrieved 2017-01-27.

· · Hutton-Shearson Deal Announced“. The New York Times, December 4, 1987.

· · “Hutton Sets Fees“. The New York Times, December 9, 1987

· · King of Capital, pp. 45-56

· · A Big Fund Ready to Capitalize on Hard Times. The New York Times, November 13, 1987

· · The Blackstone Group L.P., Form S-1, Securities And Exchange Commission, March 22, 2007

· · “Mortgage Unit Leaders To Join Blackstone“. The New York Times, March 4, 1988

· · “Nikko Acquires 20% of Blackstone Group“. The New York Times, December 13, 1988

· · King of Capital, pp. 144–147

· · “Stockman Forming Own Buyout Concern“. The New York Times, September 17, 1999

· · “Stockman Is Charged With Fraud“. The New York Times, March 27, 2007

· · “Sony and CBS Records: What a Romance!“. The New York Times, September 18, 1988

· · “CNW Accepts Buyout Bid From Blackstone Group“. The New York Times, June 7, 1989

· · “2 Wall Street Firms Join To Buy Savings Units“. The New York Times, May 12, 1989

· · U.S. Mergers Firm Is Forming British Link. The New York Times, April 23, 1990

· · Chairman Is Named For Blackstone Unit. The New York Times, April 5, 1991

· · Prime to Sell Interest in Inns to Blackstone. The New York Times, May 24, 1990

· · Blackstone Unit to Buy Days Inns. The New York Times, October 1, 1991

· · Hospitality to Acquire Super 8 Motels. The New York Times, February 17, 1993

· · The Loewen Group and Blackstone Capital Partners form corporate venture to acquire Prime Succession. Business Wire, June 17, 1996. Accessed 2009-02-20.

· · Loewen And Blackstone To Make Joint Purchase. The New York Times, June 18, 1996

· · Loewen Buys Big Cemetery, And Its Suitor Criticizes Deal. The New York Times, September 21, 1996

· · “BlackRock: The $4.3 trillion force”. Fortune. Retrieved 2019-07-04.

· · Blackstone Raises $4 Billion for Fund. The New York Times, October 10, 1997

· · Red-Hot Revival in Real Estate; Overheating Is Feared With Surge in Vulture Investing. The New York Times, November 6, 1997

· · A.I.G. Will Put $1.35 Billion Into Blackstone. The New York Times, July 31, 1998

· · Blackstone to Form a New Financing Unit. The New York Times, April 8, 1999

· · King of Capital, pp. 145-146

· · A trash hauler is buying a much bigger rival, a type of deal that makes Wall Street a bit nervous. The New York Times, March 9, 1999

· · King of Capital, pp. 148–155

· · Cube, Christine (Nov 25, 2002). “Watergate Hotel For Sale”. Washington Business Journal.

· · Staff Report (Aug 19, 2004). “Monument Realty Buys Watergate Hotel”. Commercial Real Estate Direct.

· · “Blackstone Acquires Debt on 7 World Trade Center”. Business Wire. October 17, 2000.

· · Photographed at the World Economic Forum in Davos, Switzerland in January 2008.

· · Blackstone Amasses a Record Equity Fund. The New York Times, July 17, 2002

· · Vivendi Finishes Sale of Houghton Mifflin To Investors. The New York Times, January 1, 2003

· · Sender, Henny. “At Blackstone, James Builds A Following”. The Wall Street Journal. Retrieved 23 March 2007.

· · King of Capital, pp. 176, 197, 206-207

· · Blackstone Group May Purchase Auto Parts Business From TRW. The New York Times, November 13, 2002

· · Blackstone Buys Majority Stake in Columbia House. The New York Times, May 15, 2002

· · A Split-Up of Insurers of Bonds Is Considered. The New York Times, February 16, 2008

· · King of Capital, p. 225

· · “Capital Firms Agree to Buy SunGard Data in Cash Deal.” Bloomberg L.P., March 29, 2005

· · Do Too Many Cooks Spoil the Takeover Deal?. The New York Times, April 3, 2005

· · “Blackstone To Rationalize Single Manager Hedge Funds Businesses In Efficiency Move” (Press release). Business Wire. December 23, 2008.

· · The Blackstone Group to Acquire Prime Hospitality Corp. Press Release, August 18, 2004. Accessed 2009-02-20 Archived March 8, 2005, at the Wayback Machine

· · Silverman, Gary; Nicolaou, Anna Nicolaou (2016-10-21). “Steve Bollenbach, hospitality executive, 1942-2016”. Financial Times. Retrieved 19 December 2018. He served as chief financial officer of Marriott and Walt Disney and chief executive of Hilton Hotels, a post he held from 1996 to 2007, when he sold the company to Blackstone for $26bn. … He helped craft Marriott’s 1992 split into a hotel management operation and a real estate holding company, as well as Disney’s $19bn deal to buy Capital Cities/ABC in 1995.

· · Private-Equity Firm Sees Room for Value in Hotels. Wall Street Journal, August 17, 2005

· · http://ir.lq.com/Cache/1500058950.PDF?Y=&O=PDF&D=&FID=1500058950&T=&IID=4424891[permanent dead link]

· · Equity Firms Buy Danish Phone Company. The New York Times, December 1, 2005

· · King of Capital, pp. 239–254

· · Blackstone’s Bid for Equity Office Prevails The New York Times, February 8, 2007

· · King of Capital, 231-235

· · Sorkin, Andrew Ross and Flynn, Laurie J. “Blackstone Alliance to Buy Chip Maker for $17.6 Billion.” The New York Times, September 16, 2006

· · Consortium Buys Michaels for $6 Billion. The New York Times, July 1, 2006

· · VNU Shareholders Reject $8.9 Bln Offer From KKR Group. Bloomberg, March 8, 2006

· · Buyout Bid For Parent Of Nielsen. The New York Times, January 17, 2006

· · VNU Agrees To Public Offer From Private Equity Group. Press Release, March 8, 2006

· · “Company News Headlines”. NASDAQ.com. June 2, 2011. Retrieved 2013-01-29.

· · Cadbury Sells Beverage Unit to Two Firms. The New York Times, November 22, 2005

· · Parkinson, Gary (October 26, 2006). “Private-equity companies snap up United Biscuits in a £1.6bn deal”. The Independent. Retrieved 2007-04-12.

· · “Blackstone and PAI complete purchase of UB” (Press release). United Biscuits. December 15, 2006. Archived from the original on September 27, 2007. Retrieved 2007-04-12.

· · “The Blackstone Group Has Completed Its Acquisition of a Controlling Interest in RGIS” (Press release). Business Wire. May 1, 2007.

· · “Biomet, Inc. to Be Acquired by Private Equity Consortium for $10.9 Billion or $44 Per Share in Cash” (Press release). Business Wire. December 18, 2006.

· · Blackstone to Buy Hilton Hotels for $26 Billion. The New York Times, July 4, 2007

· · High-Water Mark. The New York Times, July 4, 2008

· · King of Capital, pp. 299–300

· · Private Firms Use Closed-End Funds to Tap the Market. The New York Times, April 17, 2004

· · Blackstone Group Postpones Fund Offering. The New York Times, July 16, 2004

· · King of Capital, pp. 221–223

· · Sender, Henny (November 23, 2012). “KKR buys Alliant in ‘pass the parcel’ deal”. Financial Times.

· · Sorkin, Andrew Ross and de la Merced, Michael J. “News Analysis Behind the Veil at Blackstone? Probably Another Veil.” The New York Times, March 19, 2007.

· · Equity Firms Acquiring Food Supplier. Bloomberg, January 19, 2008

· · Blackstone, Wellspring to acquire Performance Food Group in $1.3bn deal. AltAssets, January 18, 2008 Archived June 11, 2008, at the Wayback Machine

· · Flint, Joe (November 8, 2013). “Byron Allen’s Company Buys Weather Channel for $300 Million”. The Wall Street Journal.

· · “Anheuser-Busch Inbev and Blackstone announce completion of sale of Busch Entertainment Corporation” (Press release). Anheuser-Busch InBev. December 1, 2009.

· · David, Ruth; Doff, Natasha (November 8, 2013). “Merlin Entertainments Gains on Debut After $1.5 Billion IPO”. Bloomberg L.P.

· · Saigol, Lina; Cadman, Emily (November 8, 2013). “Merlin Entertainments shares rise on London stock market debut”. Financial Times.

· · PRIMACK, DAN (November 23, 2010). “Over and out: Dynegy and Blackstone call it quits”. Fortune.

· · Whitley, Angus; Saminather, Nichola (February 28, 2011). “Blackstone Said to Acquire Centro’s U.S. Shopping Centers for $9.4 Billion”. Bloomberg.

· · Yu, Hui-Yong (August 10, 2016). “Blackstone Sells Rest of Stake in Shopping-Center REIT Brixmor”. Bloomberg L.P.

· · “Blackstone Completes Acquisition of Emdeon” (Press release). PR Newswire. November 2, 2011.

· · “Blackstone agrees to hand over Jack Wolfskin to lenders”. Reuters. April 12, 2017.

· · Foxman, Simone (August 8, 2012). “WHEW: Blackstone Almost Bought Knight Capital Before Its Stock Collapsed”. Business Insider.

· · Scott, Mark (May 22, 2012). “Accor to Sell Motel 6 to Blackstone for $1.9 Billion”. The New York Times.(subscription required)

· · “Blackstone Announces Closing of Vivint Transaction” (Press release). Business Wire. November 19, 2012.

· · Jacobson, Julie (February 15, 2013). “Nortek to Acquire 2Gig for $135M, Fold into Linear Security”. cepro.com. CEPro. Retrieved 10 May 2018.

· · “Blackstone drops out of race to buy Dell”. USA Today. Associated Press. April 19, 2013.

· · “First Potomac Realty Trust Completes Sale Of Industrial Portfolio For $259 Million” (Press release). PRNewswire. June 18, 2013.

· · Neibauer, Michael (February 10, 2016). “StonebridgeCarras to transform industrial park opposite Potomac Yard”. Retrieved 19 November 2018.

· · “Blackstone Announces Strategic Investment in ThoughtFocus Technologies” (Press release). Business Wire. September 30, 2013.

· · “Blackstone Closes Acquisition of Strategic Partners from Credit Suisse” (Press release). Business Wire. August 5, 2013.

· · Versace deal with Blackstone values group at 1 billion euros, Reuters, February 26, 2014

· · Zargani, Luisa (27 February 2014). “Versace Sells Minority Stake to Blackstone”. Women’s Wear Daily. Retrieved 27 February 2014.

· · Vuong, Andy (April 20, 2014). “Blackstone grants $4 million to create Colorado entrepreneurs network”. The Denver Post.

· · Schuetze, Arno; Taylor, Edward (May 15, 2014). “Deutsche Bank sells casino to Blackstone for $1.7 billion”. Reuters.

· · “Vine Oil & Gas and Blackstone Energy Partners to Acquire Shell’s Haynesville Assets” (Press release). Business Wire. August 14, 2014.

· · “Blackstone Announces Sale of Gold Fields House in Sydney to Dalian Wanda Group” (Press release). Business Wire. January 26, 2015.

· · “Adding on to the Willis Tower?”. Crain’s Chicago Business. 2015-06-05. Retrieved 2019-08-25.

· · “Blackstone Completes Acquisition of Excel Trust” (Press release). MarketWired. July 31, 2015.

· · “Blackstone to Sell GCA Services Group to Thomas H. Lee Partners and Goldman Sachs” (Press release). Business Wire. November 16, 2015.

· · “Blackstone Completes Acquisition Of BioMed Realty Trust” (Press release). PR Newswire. January 27, 2016.